Showing posts with label WhatsApp. Show all posts

Showing posts with label WhatsApp. Show all posts

Wednesday, November 11, 2020

WhatsApp Pay

Tuesday, January 8, 2019

The truth of Circulating whatsapp message "Prime Minister Ayushman Bharat Scheme"

व्हाट्सएप पर।

आप लोगों को भी इस तरह के संदेश मिले हैं।

*प्रधानमंत्री आयुष्मान भारत योजना*

13 से 70 साल के 10 करोड़ लोगो को 5 लाख रुपये का निःशुल्क बीमा दिया जा रहा है।

*आवेदन करने की अंतिम तिथि 15 जनवरी 2019 है* तो जल्दी करें और इस मैसेज को अपने सभी दोस्तों को भी भेजें ताकि इस योजना का लाभ सभी को मिल सके |

*अभी आवेदन करें*👇👇

http://ayushmaan-bharat.sarkari-yojana.co.in

on whatsapp.you also have received such messages from people.

*प्रधानमंत्री आयुष्मान भारत योजना*

13 से 70 साल के 10 करोड़ लोगो को 5 लाख रुपये का निःशुल्क बीमा दिया जा रहा है।

*आवेदन करने की अंतिम तिथि 15 जनवरी 2019 है* तो जल्दी करें और इस मैसेज को अपने सभी दोस्तों को भी भेजें ताकि इस योजना का लाभ सभी को मिल सके |

*अभी आवेदन करें*👇👇

http://ayushmaan-bharat.sarkari-yojana.co.in

Let's find out the truth behind such links promotions

आइए जानें ऐसे लिंक प्रमोशन के पीछे की सच्चाई।

as mentioned in figure they buys a domain("sarkari-yojana.co.in") and creates a sumdomain ("ayushmaan-bharat")and loads some website scripts and rund such fake site just to collect peoples personal data and wana to earn from ads networks.

जैसा कि उन्होंने बताया कि एक डोमेन ("sarkari-yojana.co.in") खरीदता है और एक समडोमन ("ayushmaan-bharat") बनाता है और कुछ वेबसाइट स्क्रिप्ट लोड करता है और ऐसे फर्जी साइट को रफ करता है ताकि सिर्फ व्यक्तिगत डेटा और कमाई करने के लिए धन इकट्ठा किया जा सके। विज्ञापनों के नेटवर्क से।

for more information you can check WHOIS directory,this Directory provides almost all domains on web.

Domain search results are below

अधिक जानकारी के लिए आप WHOIS निर्देशिका की जांच कर सकते हैं, यह निर्देशिका वेब पर लगभग सभी डोमेन प्रदान करती है।

डोमेन खोज परिणाम नीचे हैं।

Sunday, February 25, 2018

A step-by-step guide to using WhatsApp Pay

WhatsApp is testing its payment feature in India which will allow users to send and receive money through the chat app.

WhatsApp Pay is based on the Indian government's Unified Payments Interface (UPI), a real-time payment system that merges several bank accounts into a single platform.

If you are a part of the initial roll-out, here is how you can use the feature.

You will first have to link your bank account to WhatsApp. This can be done by going to Settings > Payments > Bank Accounts.

Go through the terms and conditions and add a new account.

For successful linking, please make sure that your WhatsApp number and your mobile number linked to your bank account are the same.

Go through the terms and conditions and add a new account.

For successful linking, please make sure that your WhatsApp number and your mobile number linked to your bank account are the same.

Create a UPI pin for authentication of transactions

Once your mobile number has been verified, you can choose from the list of over 70 Indian banks for the account you want to link to WhatsApp Pay.

Finally, enter the last six digits of your debit card and its expiry date, and your bank account addition is done.

Next, set up a four-digit UPI pin that will be used to authenticate your transactions.

The Payment.

Get ready to settle that pizza bill through WhatsApp Pay

Now you can make your first payment on WhatsApp. To send money, open the chat window of the receiver and tap on 'attachments.'

Select the 'Payments' icon, enter the amount you want to send, confirm your UPI pin, and it's done. Simple!

Please note that in order for the transaction to be successful, the receiver will also have to activate his WhatsApp Pay.

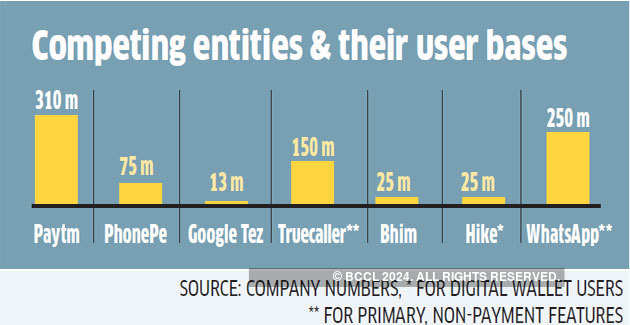

WhatsApp Pay will compete with Paytm, MobiKwik WhatsApp Pay will maintain a payment history of all transactions as well. The feature, that won't include merchant payments, is expected to take on popular digital wallets like Paytm, Google Tez, and MobiKwik. Currently, WhatsApp has over 200 million monthly active users in India.

Saturday, February 24, 2018

This new feature is arriving soon on WhatsApp

This feature has been spotted on WhatsApp beta version 2.18.54 and later versions for Android and WhatsApp bet... Read More

WhatsApp seems to be on quite a roll when it comes to launching new features and services. In the last six months, the popular messaging app has been actively upgrading features. The latest addition is a new feature for group chat users, called the Group Descriptions. As the name suggests, this feature enables users to add a up to 500 characters’ description for the members of any group.

As per reports, the feature of adding a description for a group is not restricted to just the admins but can be added by any member in the group. However, this may be changed in the future. Also, this description is visible only to fellow group members who have this option of adding the description, others don’t see it. Once the description is added, the group chat gets a notification as well that ‘Person’s name has changed the group description. Tap to view.’ If you remove the description, that gets recorded on the group chat too.

This feature has been spotted on WhatsApp beta version 2.18.54 and later versions for Android and WhatsApp beta version 2.18.28 on Windows Phone as of now and is soon expected to be rolled out to iOS users as well.

Amidst all this, WhatsApp has also been gearing up to roll out, what can easily be called as one of the biggest features since the 'Delete for Everyone', WhatsApp payment option. This feature has been rolled out to select Beta users on both Android and iOS. It is based on Unified Payment interface and (UPI) requires both sender and receiver should to have the UPI payment option enabled. To enable this payment option, WhatsApp has partnered with various banks in the country including ICICI Bank, HDFC Bank, Axis Bank, SBI, Yes Bank and others.

Sunday, February 18, 2018

Why WhatsApp's entry into payment arena could change Indian banking forever

After months of anticipation, WhatsApp rolled out its payments feature to select users across the country to much enthusiasm this week, providing a strong boost to India’s digital payments ecosystem. But that didn’t almost happen because of the company’s foreign origin. Turns out, this was WhatsApp’s second endeavour to enter India’s payments market.

Last year, the messaging app, the largest in India, tried to partner with a private bank in the country to develop a digital wallet app to facilitate payments on its platform. That was when it ran into a reluctant Reserve Bank of India. The regulator was not ready to allow a foreign entity to enter India’s digital payments space, according to multiple stakeholders ET spoke with to piece together the story behind WhatsApp payments.

“Non-bank entities applying for authorisation shall be a company incorporated in India and registered under the Companies Act 1956 / Companies Act 2013,” read RBI’s master guidelines for prepaid payments instruments, or digital wallets. WhatsApp being a Facebook owned company based in the United States, therefore, could not directly enter the Indian payments market.

Meanwhile, an important transformation was happening in India last year, with the government actively promoting the Unified Payments Interface as part of its push to digitise India’s economy. UPI, which allows for real-time bank-to-bank transactions, put up fewer entry barriers and foreign entities including Google began to rush in. WhatsApp took its time jumping on to the bandwagon. People familiar with the company’s thinking said it was not confident of the UPI story since the payments protocol had not yet picked up steam in the early half of 2017.

Since Facebook had a decent experience of bringing in payments through its Messenger platform in the US, it wanted to bring in a similar digital wallet platform in India as well. But with UPI gaining traction as the year progressed, and with other tech companies innovating on the platform, WhatsApp decided to take the plunge. In its second coming, WhatsApp payments, with its large numbers and intuitive user interface, promises to disrupt India’s digital payments ecosystem all over again.

WhatsApp payments—its first, globally—throws up new challenges for existing payments companies, mobile wallets and banks to hold on to their market shares.

The Numbers Advantage

Consumer payment is a low-margin game and the business is completely defined by the scale of operations. On this front, WhatsApp has the potential to emerge as the dominant player because of its user base of more than 250 million in India, according to industry estimates. Moreover, the ease of use of WhatsApp’s payments feature can only attract more people to adopt digital payments. WhatsApp’s user interface has received rave reviews on social media, including from payments companies.

“Just tried WhatsApp Payments, got reminded what great user experience is all about,” tweeted Amrish Rau, chief executive of payments company PayU India. Snapdeal CEO Kunal Bahl tweeted: “Quite fascinating to see how many people have already started using WhatsApp for payments in a matter of few days…”

Even in its beta stage with only a small percentage of its users getting access to the payments feature, WhatsApp seems to have caught the imagination of Indians.

A Peek Back In Time

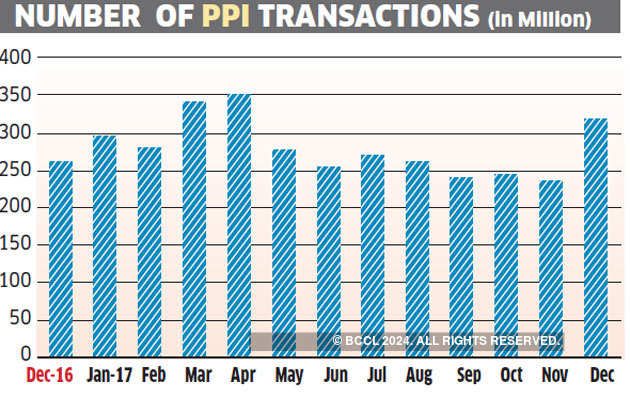

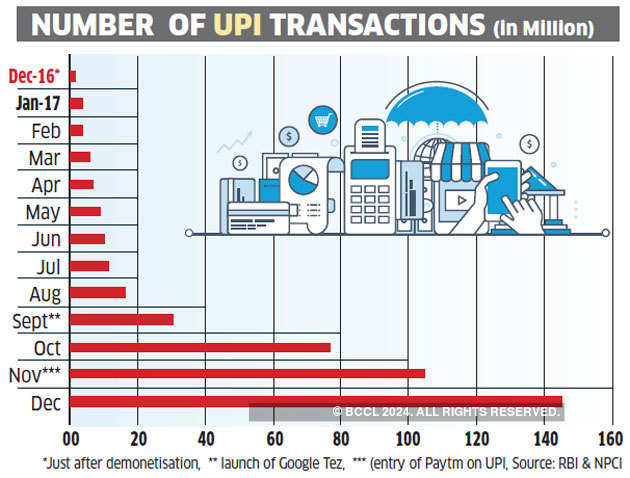

To understand the importance of user experience and brand recall in payments, it is important to bring in some context to the Unified Payments Interface, which was launched in August 2016 by then Reserve Bank of India Governor Raghuram Rajan. Initially, there were only 21 banks on the UPI protocol. This January, that number was at 71. UPI transactions have vaulted from about 2 million in December 2016 to a staggering 151.8 million in January.

The sharpest jump was in October last year, when transactions more than doubled to 76.7 million from around 30.7 million in September following the launch of Google Tez and its various cashbacks that has attracted thousands of users. Subsequently, India’s largest payments company Paytm, too, went live on UPI, providing a huge boost to the number of UPI transactions in December and January.

“We had the application but we did not have the correct marketing strategies to take the product to the public and promote it in a major way,” said a senior executive with a private bank that has been a part of UPI right from the beginning.

“The tech-based payments players have always driven UPI payments.” The fact that global giants like Google and Facebook are opening up payments applications in India for the first time in the world is testimony to the global standard settlements infrastructure created by National Payments Corp of India, say bankers.

NPCI manages the UPI protocol. While the launch of UPI was expected to give banks a fillip in their fight against new payment services, most of them are now focusing on getting big partners like Google and WhatsApp on board.

But All Is Not Well

Soon after WhatsApp’s payments feature became live, the waters became murky with Paytm raising a hue and cry about the safety of the WhatsApp payments platform. Paytm CEO Vijay Shekhar Sharma also alleged that WhatsApp was given too much leeway to ensure a better payments experience for customers.

“Facebook is openly colonising our payment system and is customising UPI to their benefit. UPI was built as an India Stack; now some American monopoly arm-twists UPI for customer implementation,” Sharma told ET, adding that he plans to take the issue to NPCI, and higher authorities if required.

India Stack is the backend software infrastructure that allows technologies to be built around Aadhaar authentication and eKYC, eSign, DigiLocker, and UPI. Several entrepreneurs across the spectrum have said that WhatsApp’s entry in the Indian payments space has spooked incumbents. While several players in the industry agreed that WhatsApp was given concessions because of the user base it brings, others said its entry in the Indian payments space has spooked incumbents.

“All companies threatened by WhatsApp payments are going to tag it as anti-national and try to pull it down as it’s hard to win on merit against the network effects of WhatsApp,” tweeted Kunal Shah, founder of payments company Freecharge. “This strategy worked for Patanjali (Ayurveda-based consumer goods company) and wonder if it will work for payment companies.”

The ICICI Angle

One bank that could seem to be getting a headstart in the process of WhatsApp’s payments entry is ICICI Bank. The country’s largest private lender is the sole banking partner for WhatsApp in the beta stage of its payments roll out. It is through ICICI Bank that UPI handles are being created for all users of WhatsApp’s payments feature to transact via the chat application.

However NPCI guidelines mandate that payment platforms have to balance out the handles across every participating bank eventually, which should bring the others on to an equal footing with time. Further that doesn’t mean they get access to customer data such as savings balance or security details, which are masked by the platform. But what they get is an understanding of customer behavior.

“There are very strict security protocols to be followed for integration with the UPI backend, but what the platform or the sponsor bank get to understand is the payment behavior of the customer, which can throw up future business opportunities for the bank,” said a senior banker involved in the process. If banks or the payments platform manage to figure how to use transaction data of customers for cross-selling, they will have a huge treasure trove to dig into, he said.

“Though (WhatsApp) has started with ICICI Bank in the beta phase, there are three other banks with whom the integration work is going on, including State Bank of India, HDFC Bank and Axis Bank,” said the banker.

The Challenges

While WhatsApp on UPI is a big step, challenges are aplenty. “Unlike Google, which developed Tez from scratch for payments in India, WhatsApp was incorporating payments in its chat application itself. Therefore, it was always a challenge to bring in such large modifications in one of the busiest apps of the world,” said one of the bankers quoted above.

It is because of WhatsApp’s large user base that NPCI has not allowed a full-scale launch of the company’s payments feature, according to sources. It instead preferred a phased rollout to allow time for both the app and bank platforms to adjust to a sudden spike in volumes.

Industry insiders say the beta rollout can help with gradual strengthening of processes to ensure near-zero transaction declines by banks.

The Road Ahead

WhatsApp will have to follow every specification laid down by NPCI in its UPI requirements once its payment feature goes fully live and the platform opens up to more banking partners, said the people familiar with the developments.

“UPI has been built on the promise of an open architecture that is completely interoperable and it is this feature that has attracted so many tech companies to build solutions around it,” one of them said. “Our enemy is cash and to eliminate that India will need multiple strong payment applications to drive volume.”

The industry is awaiting another round of boom in UPI transaction numbers in the coming months. With WhatsApp, even those not using any of the other multiple payment applications for digital transactions might be willing to use its payment feature.

“My 70-year-old mother uses WhatsApp and now with payments made so simple even she can send or receive money directly into her bank account through WhatsApp payments,” said a senior banker with a private bank that’s working with WhatsApp.

“That will change India’s digital payments landscape forever.” Multiple debates have cropped up, accusations are being thrown around, and competition is bound to increase. But what can be said is that the country’s digital payments ecosystem has a bright future. The technology has been built and the products have been delivered.

Now, it is all about user adoption and that is where payments platforms will need to push more. With global companies like PayPal, Google, WhatsApp, and Truecaller on one side and Indian giants such as Flipkart-promoted PhonePe and the Alibaba and Softbank-backed Paytm on the other, Indian consumers cannot complain. All they need to do now is pick up their smartphones and start transacting.

Thursday, February 8, 2018

अब WhatsApp से भी भेज सकेंगे रुपए, ये है तरीका

वैलेंटाइनस के मौके पर WhatsApp अपने उपभोक्ताओं के लिए खास तोहफा लेकर आया है। व्हट्सएप ने UPI पेमेंट फीचर जारी करना शुरू कर दिया है। जिस के इस्तेमाल से आप अपने दोस्तो आदि को पैसे भेज पाएंगे।

इस फीचर की टेस्टिंग काफी दिनों से चल रही थी। बता दें कि व्हाट्सऐप पेमेंट सर्विस अभी सिर्फ भारत में ही शुरु की गई है। कई बीटा यूजर्स को पेमेंट का ऑप्शन मिल गया है और कई को आज रात तक मिल जाएगा। व्हाट्सऐप के अपडेट की जानकारी देने वाले WABetaInfo ने ट्वीट करके इसकी जानकारी दी है। ट्वीट में कहा गया है कि अगर आपको अभी तक पेमेंट का ऑप्शन नहीं मिला है तो कुछ घंटों बाद आपको अपडेट मिल जाएगा।

Tuesday, February 6, 2018

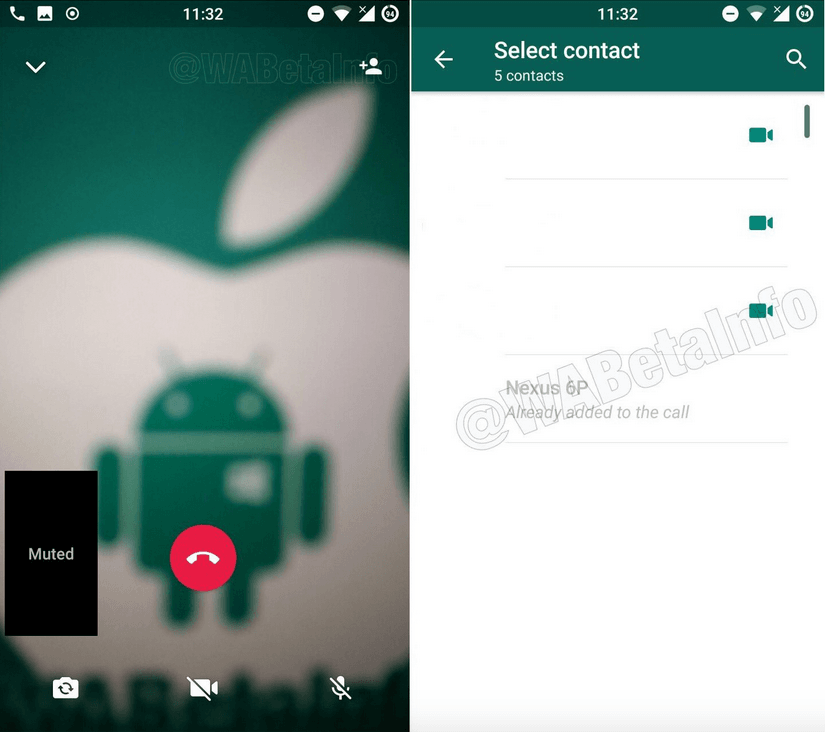

Upcoming WhatsApp Update For Android Will Let You Add 3 People In A Group Video Call

The most popular instant messaging app on the planet, WhatsApp is back in the news with another interesting upcoming feature in its kitty. WhatsApp will allow users to add up to three participants in a group video call. Yes, you heard it right. Initially, this feature will be available for Android users. Whether or not this feature makes its ways to iPhones and Windows Phones, only time will tell.

Putting it in simple words, currently, if you are on a video call with somebody then you can not add any other person. WhatsApp will be pushing this feature to Beta version 2.18.39 anytime soon. Upon release, this feature will enable you to add up to three people in your ongoing video call bringing the total up to four in a single conference call. Sounds interesting? Isn’t’ it?

According to WABetaInfo, upon the release of this feature if you are in a video call with a person then you will get an Add Person icon in the top right corner of the calling screen. As of now, it is not clear whether this feature will work with voice calls or it will be limited to video call only. But it will be nothing short of interesting to engage in a video call with all your favourite people at the same time.

Earlier, some reports were suggesting that WhatsApp will be adding group voice calling feature like Hike Messenger, but the addition of members in a video call will be an interesting feature and will also increase the video calling usage on the platform. And with this feature, WhatsApp will be looking to compete with Skype as well.

Recently, WhatsApp launched its ‘WhatsApp Business’ app on Google Play Store for small businesses for better communication with the customers in India. that being said. Mark Zuckerberg recently announced that WhatsApp has now 1.5 billion active users who are exchanging up to 60 billion messages. Out of those 1.5 billion 200 million are Indians which clearly shows how popular the app is in India. WhatsApp is also testing WhatsApp Pay and an all new WhatsApp Stickers feature currently.

Subscribe to:

Posts (Atom)